How to pay NTUC Income Insurance Loan online (GIRO or one-time payment)

So you've taken a loan out on your NTUC Income life policy, but you now want to repay it. You could do a one-time payment or monthly GIRO arrangement; I will explain both step by step. It was really frustrating to try to look for these instructions, as they weren't very clear online. You can also use the second method to pay any credit card or loans that are in the billing organisation list of your bank.

GIRO monthly repayment

- Log in to Income at https://me.income.com.sg/

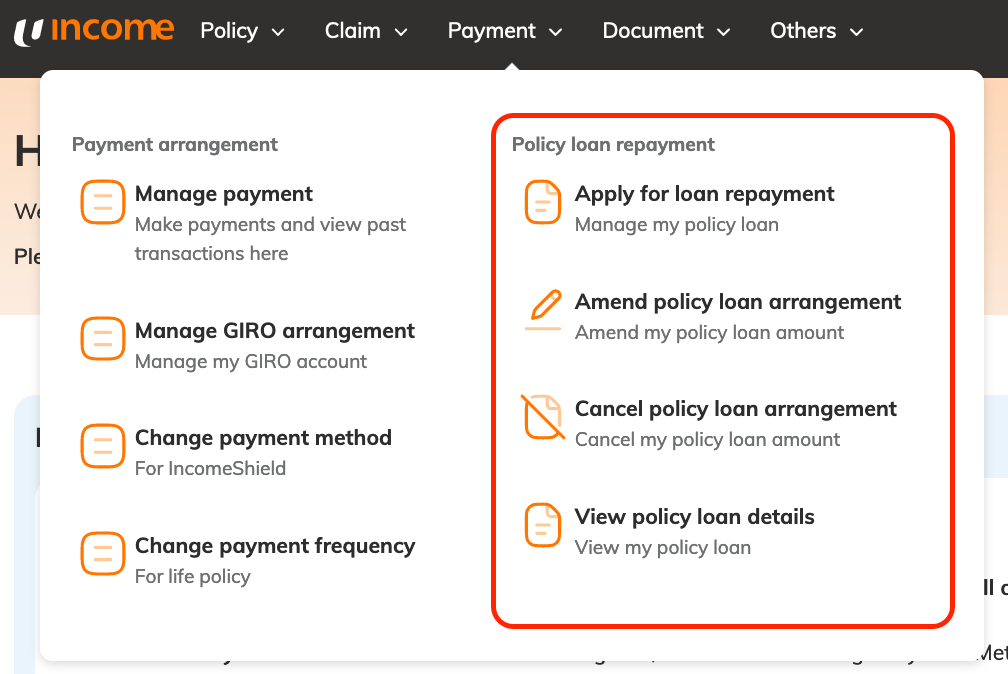

- Click on "Payment -> Apply for Loan Payment"

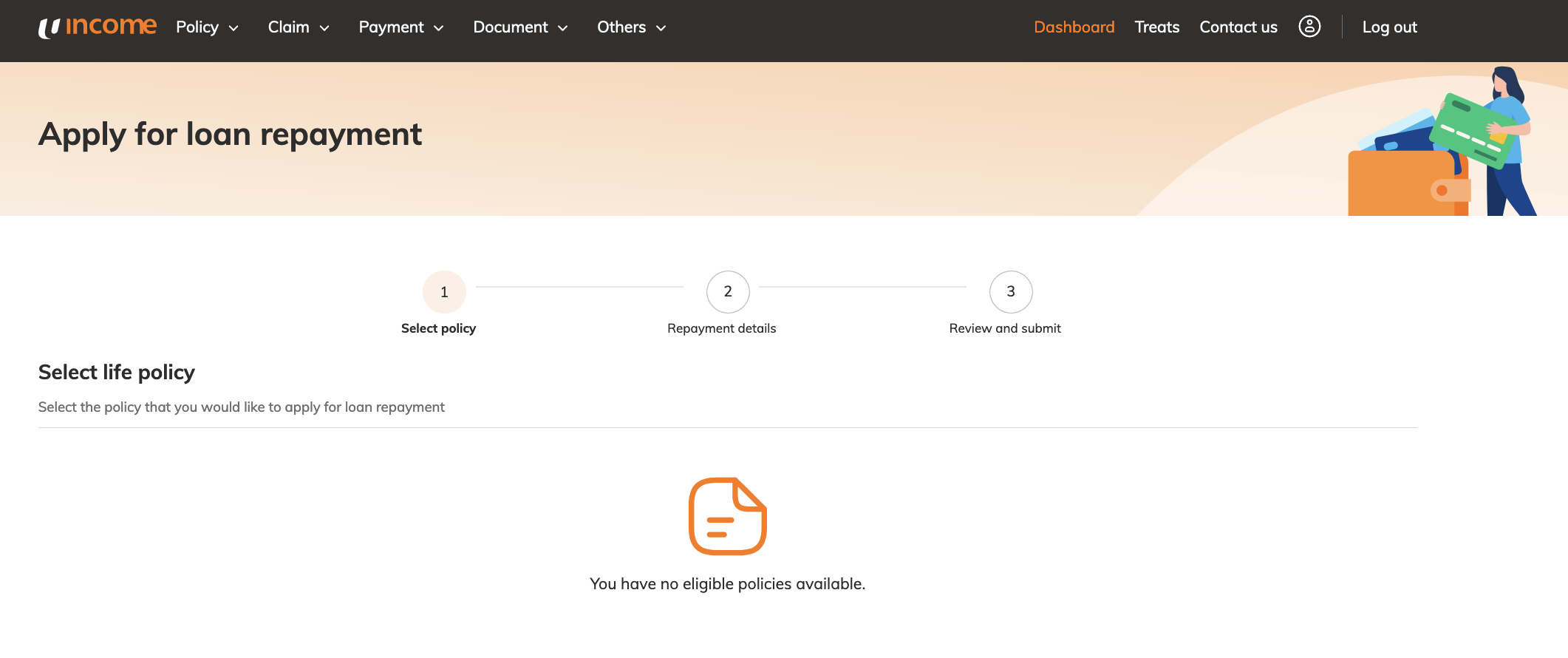

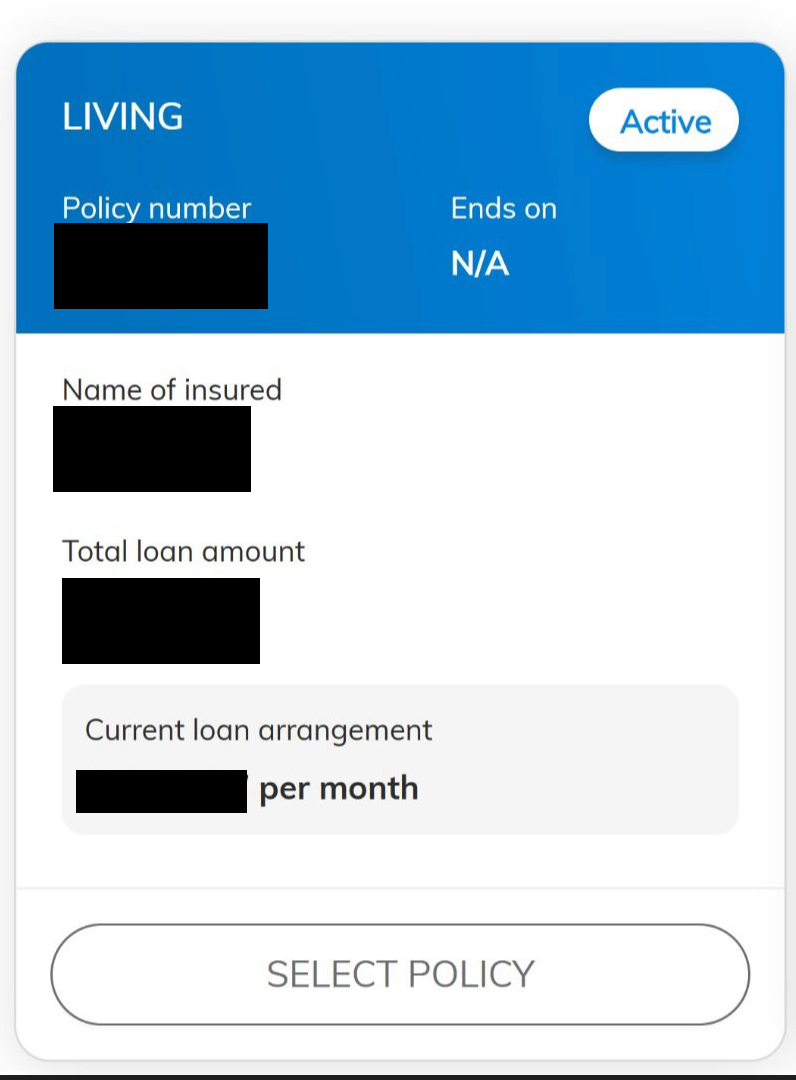

- Follow the steps here to apply for a loan repayment. If you have an option to choose here, you should see something similar to the below. Click "Select Policy" to proceed. The "total loan amount" includes the interest you will have to pay, and it will be updated daily. Your account will only be deducted to the maximum owed, so you will not overpay the loan. The deduction will be the same as other GIRO transactions, on the 6th or 18th of every month.

One-time payment

- Check how much you owe Income at https://me.income.com.sg/ following the same steps as above. If you already have an existing arrangement, click "Amend policy loan arrangement".

- Check if your preferred bank supports "Income Insurance Limited" as a billing organisation. The list for DBS is here, expand "Insurance Companies":

Personal Banking | Payment and Transfers | Bill Payment | Bill Payment Corporations | DBS Singapore

Find the list of participating Billing Organisations (BOs) and what the bill reference number is when applying for GIRO via iBanking!

- Follow the steps inside your app to pay the sum, quoting your loan repayment number that's on the offer. DBS has some instructions here; choose the Bill Payment (One-Time) option for better instructions. For internet banking, if you've never paid "Income Insurance Limited" before, click "Select Billing Organisation not in my pre-arranged list".

Make Bill Payment | DBS Singapore

You can make bill payments easily to more than 150 Billing Organisations using digibank.

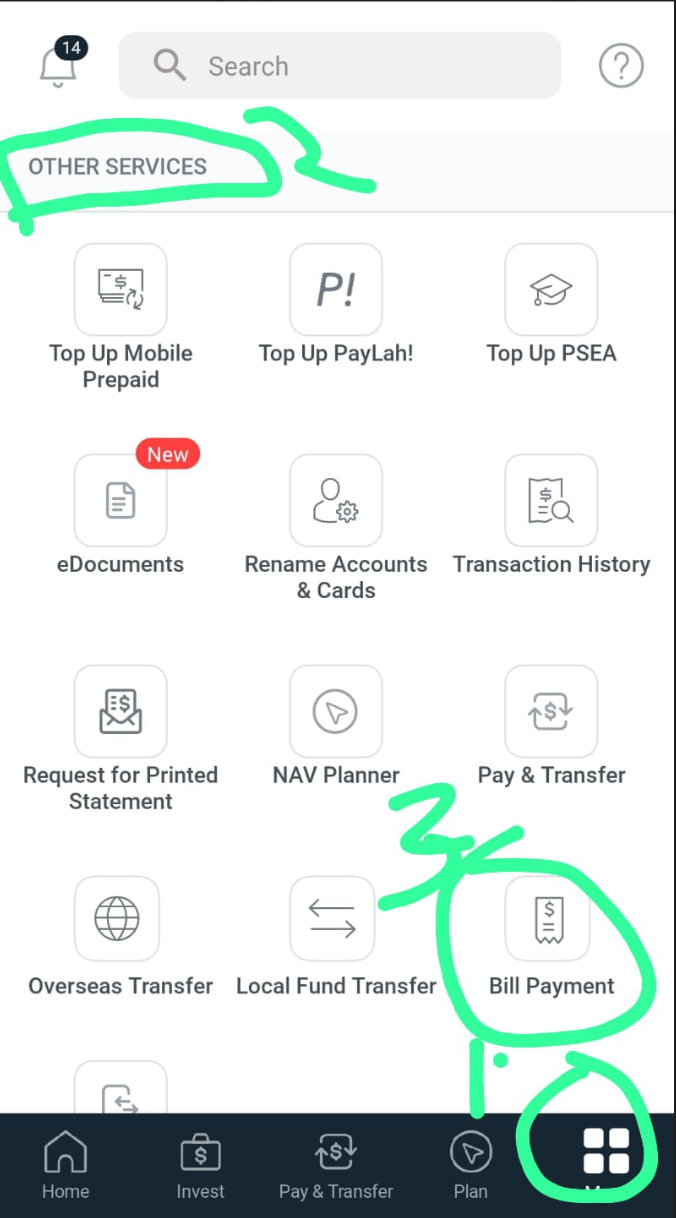

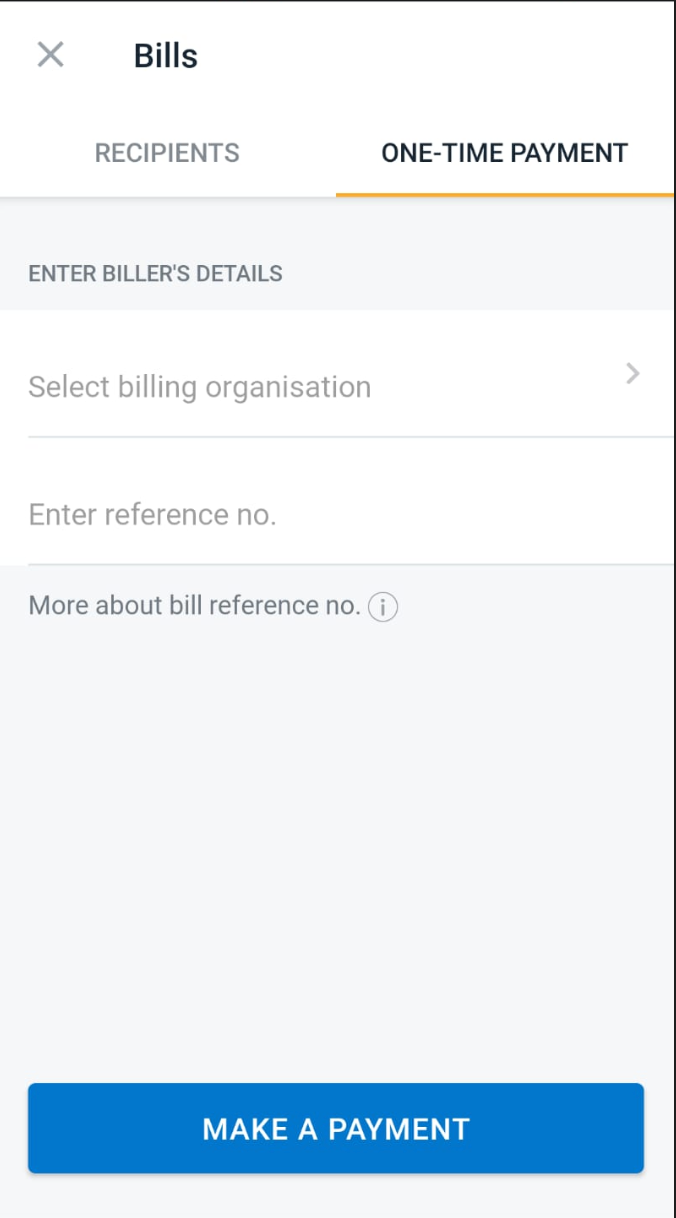

- I used mobile banking, under "More -> Other Services -> Bill Payment"

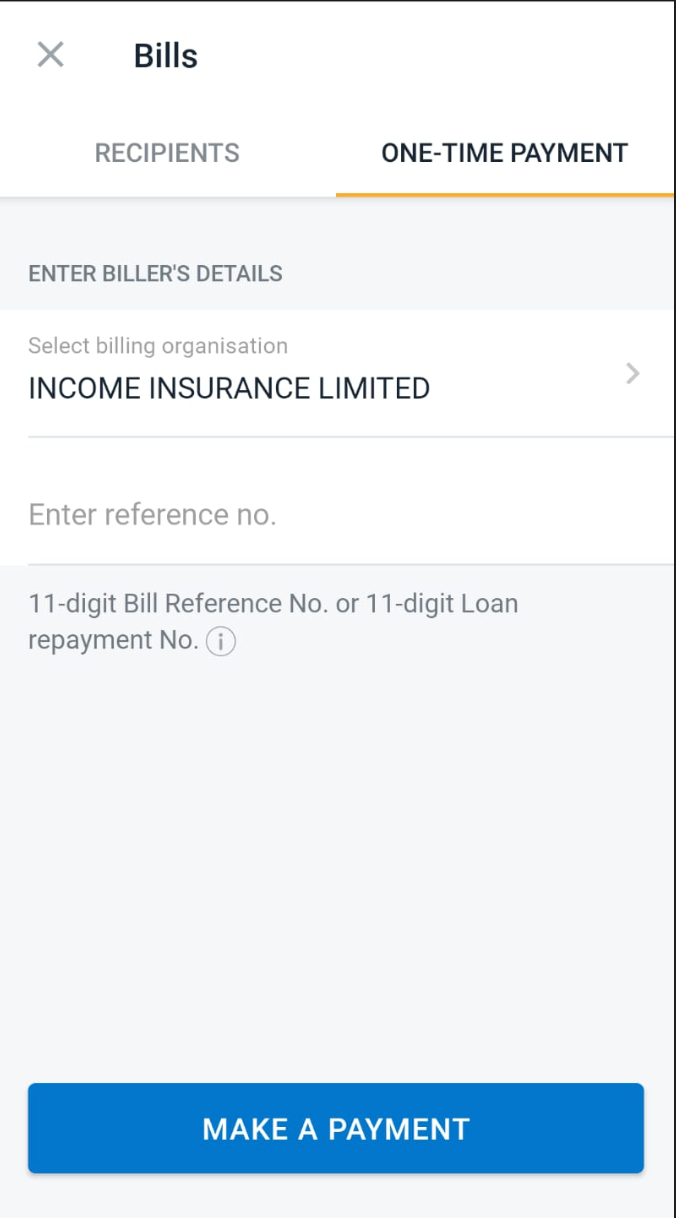

- Find "Income Insurance Limited" under "One-Time Payment", and fill in the Policy Repayment Number under "Enter Reference no.". You can copy and paste this from the email they would have sent you when the loan is approved.

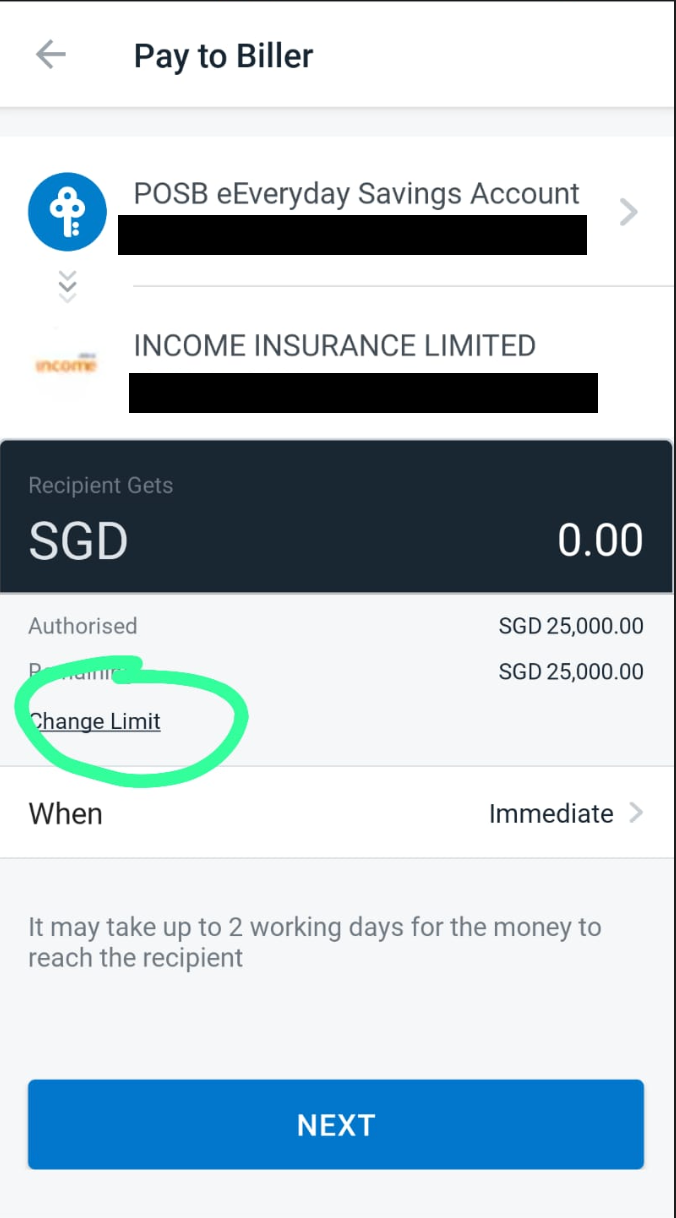

- Check that all details are correct before you pay. You may need to increase your bill limit. To do so, click "change limit".

- Take a screenshot the confirmation and send it to your Income insurance agent for verification and checking at the office.