How to take a loan on your NTUC Income Life Insurance

Being able to take out a loan on your life insurance policy is pretty handy. However, there was no how-to guide to do it, so I decided to make my own.

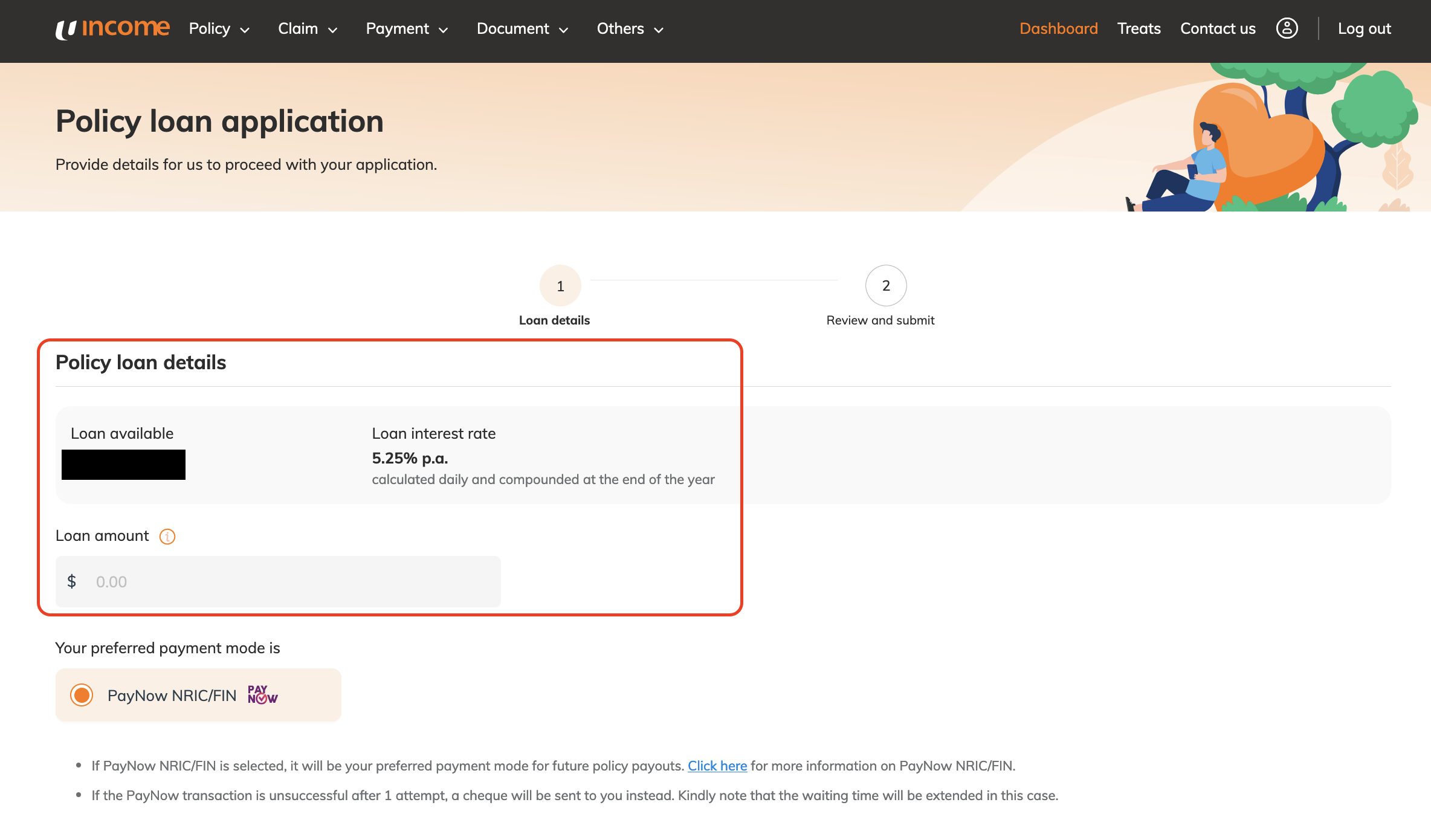

The current interest rate is 5.25% p.a. compounded yearly at the end of the year. It's a bit high but it's borrowing against your own money, so the approval is pretty fast, generally within 3 working days, sometimes even within the same day (if it is below 50k). It also isn't really counted as an official "debt" and won't impact your credit score. Here's how to use this method if you so wish to.

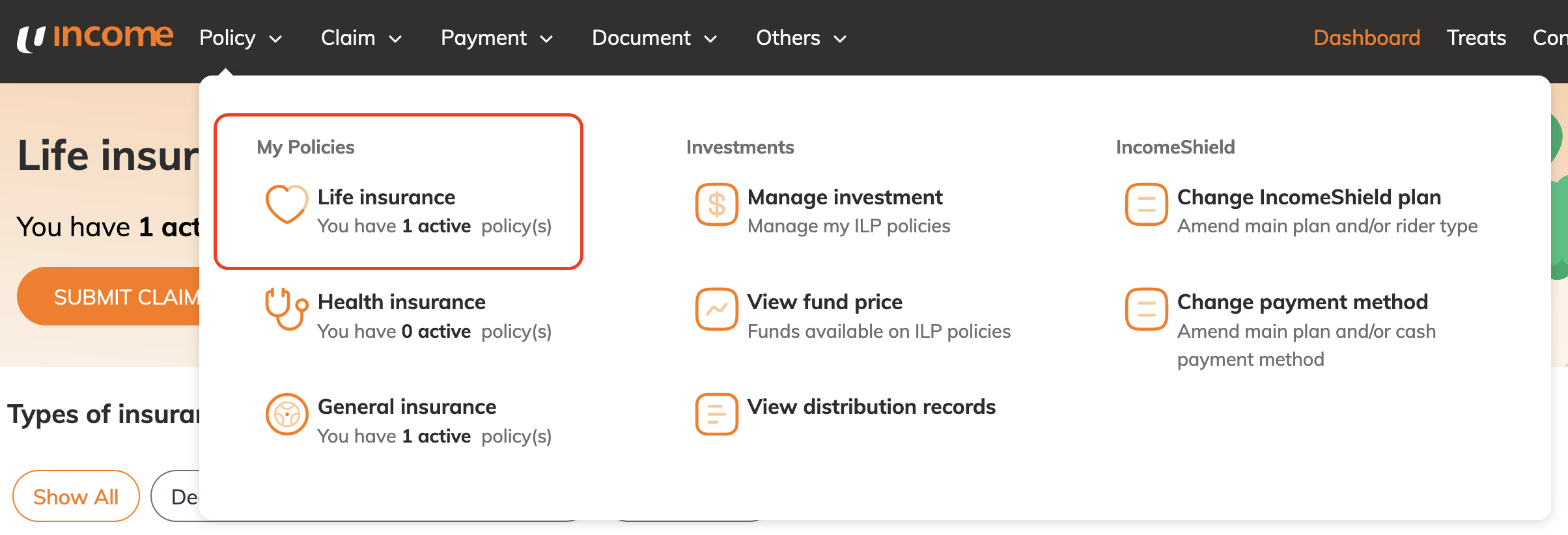

- Login to income at https://www.income.com.sg/

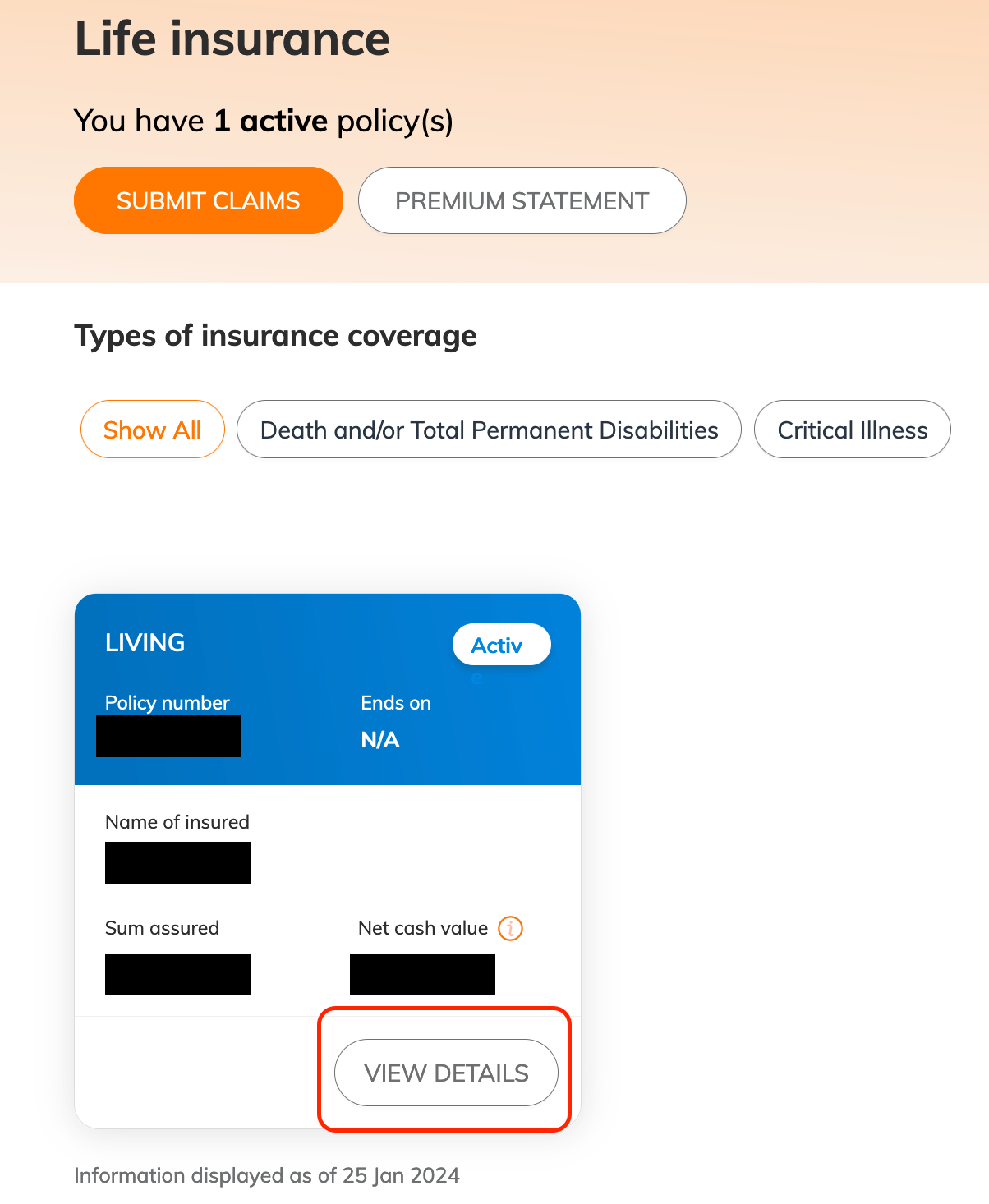

- Navigate to the life insurance page

- Click "View Details"

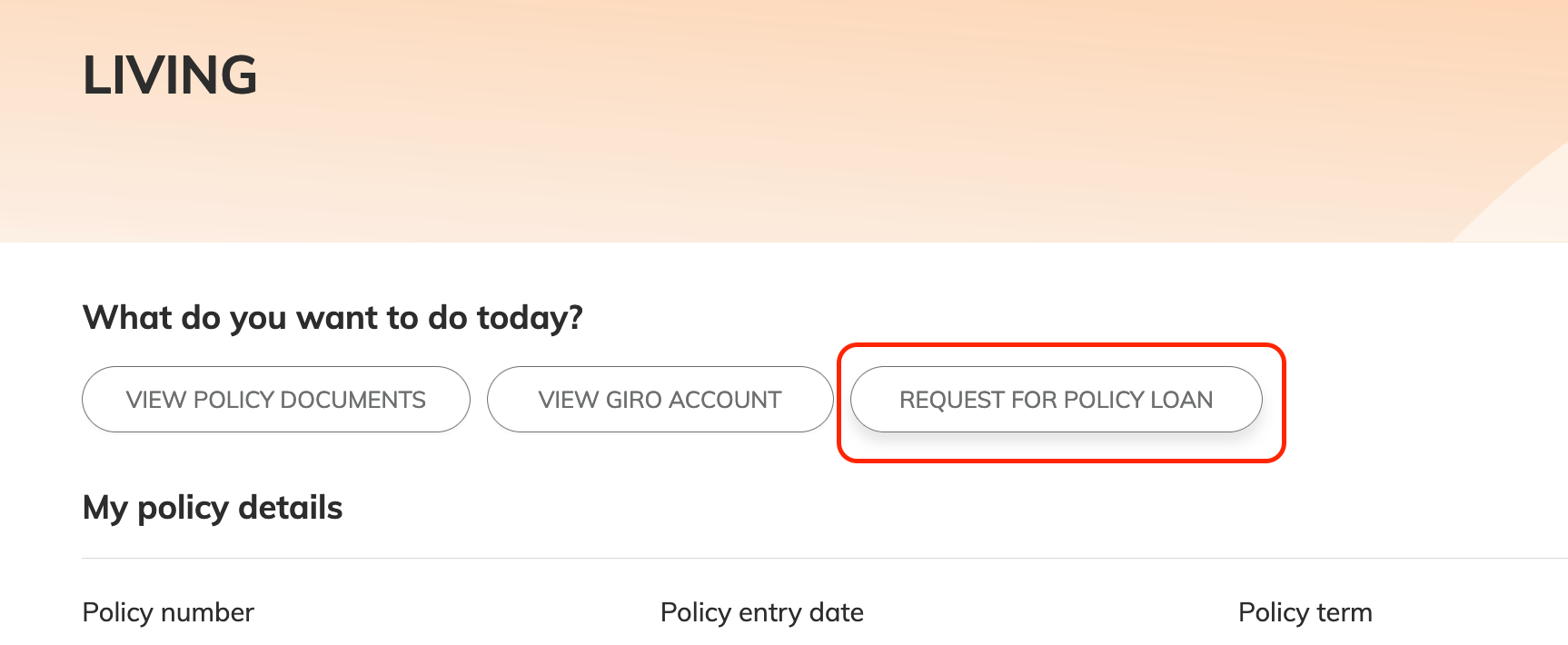

- Click "apply for policy loan"

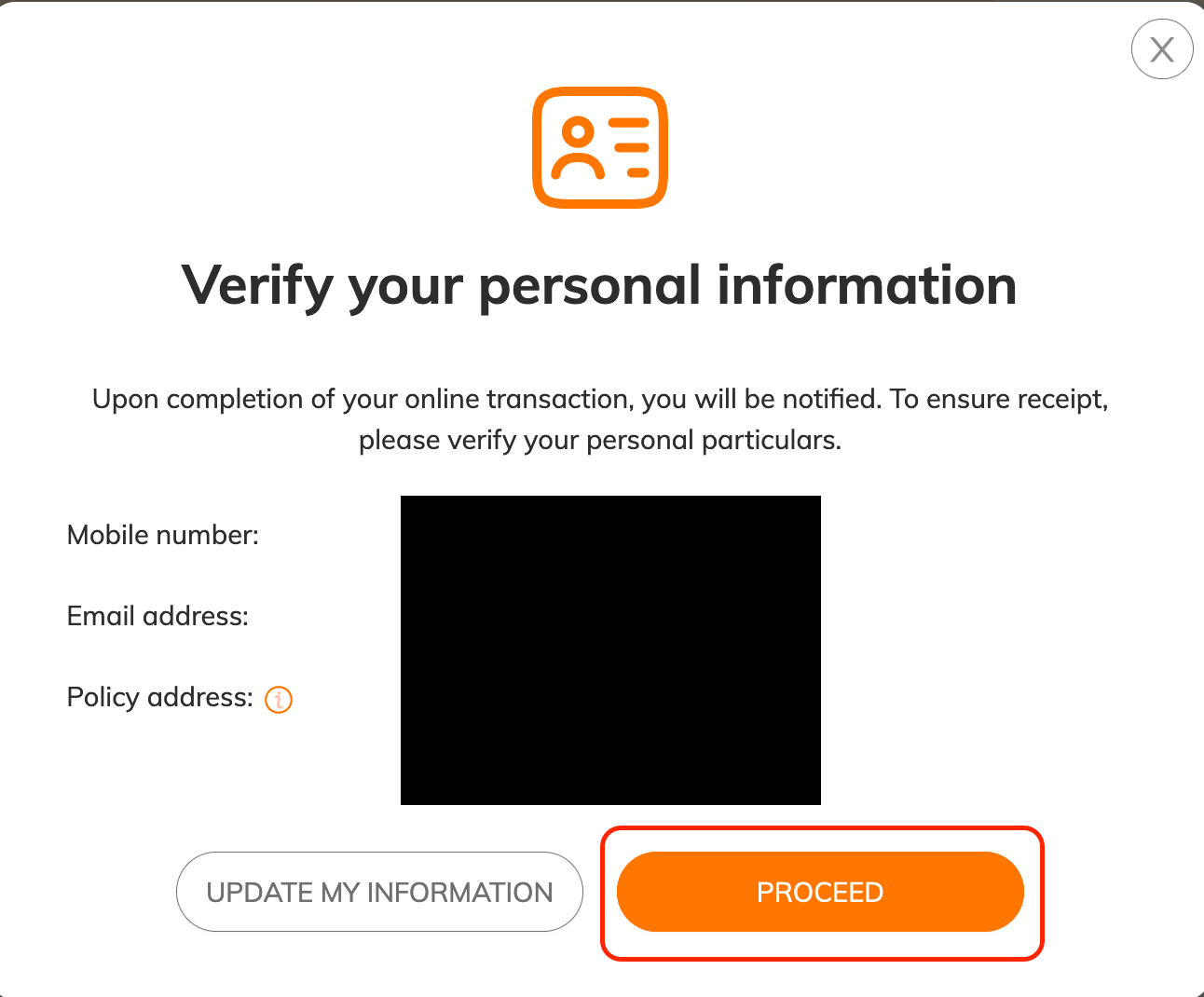

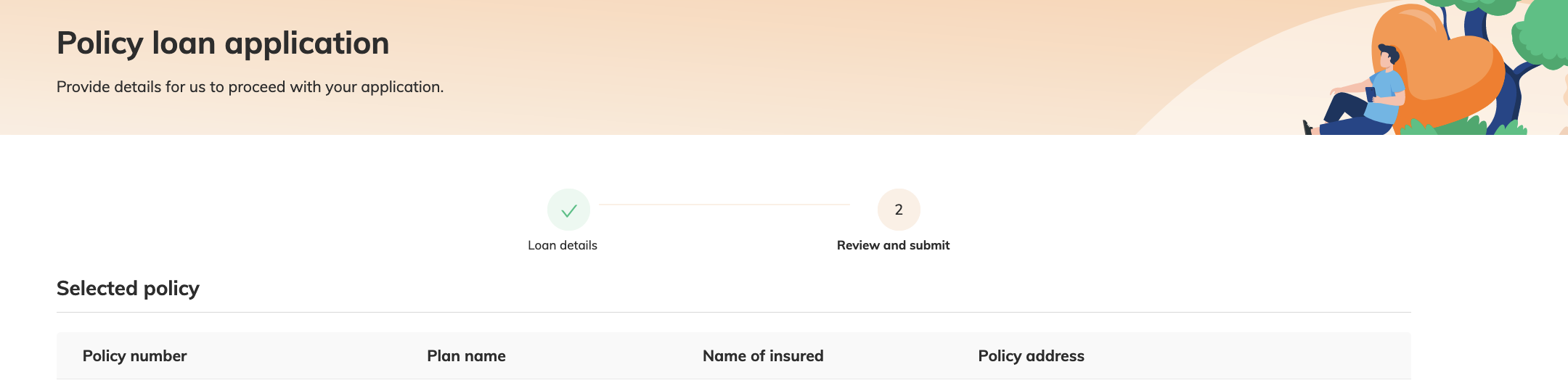

- Verify the information is correct

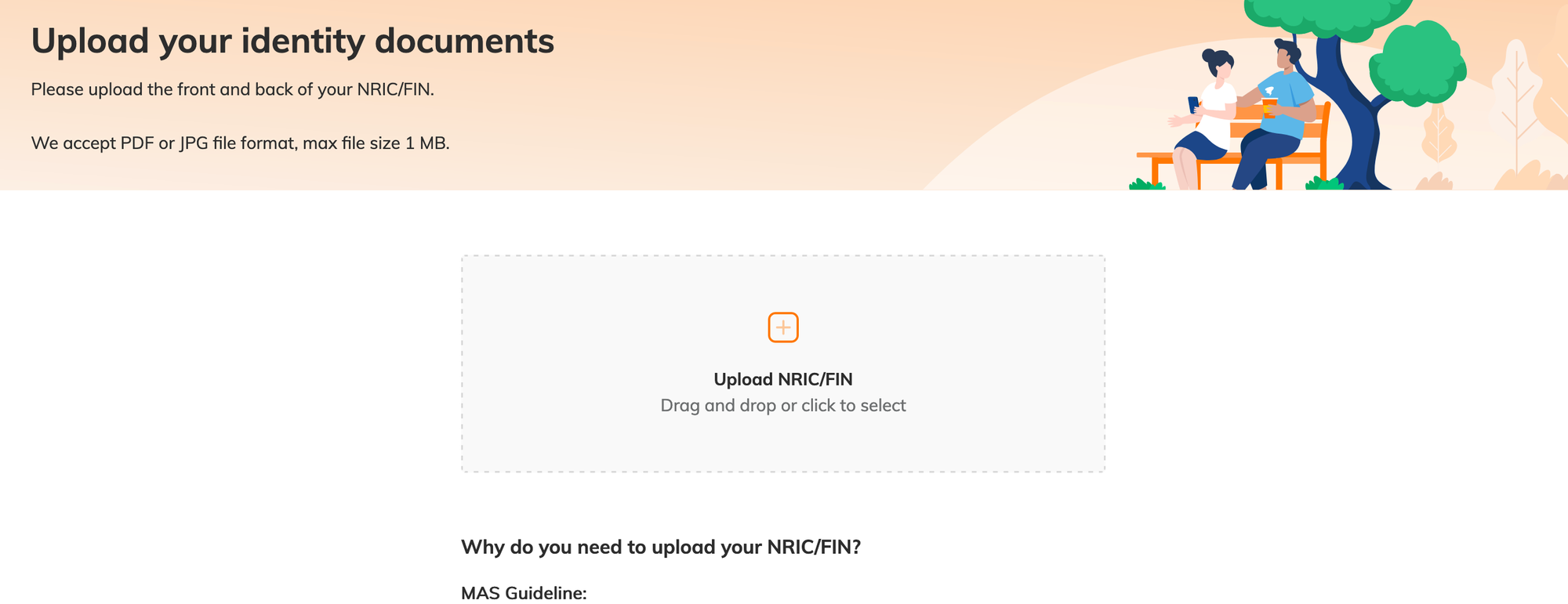

- You may need to upload your NRIC - files need to be in jpg and smaller than 1MB each. If it's too big, just take a screenshot and the size will become smaller.

- Check the policy loan details - "loan available" is the maximum loan you can take, while "loan interest rate" is how they calculate interest. The interest adds up daily, which means you can also repay it each day. You can even just loan it for one day if you like. "Loan amount" refers to the total amount you want to loan. The interest calculation is as follows:

- (number of days loaned)/(days in the year) * 0.0525 * (loan amount)

- The number of days start when you receive the money. So it should be the same date as the policy letter you will get.

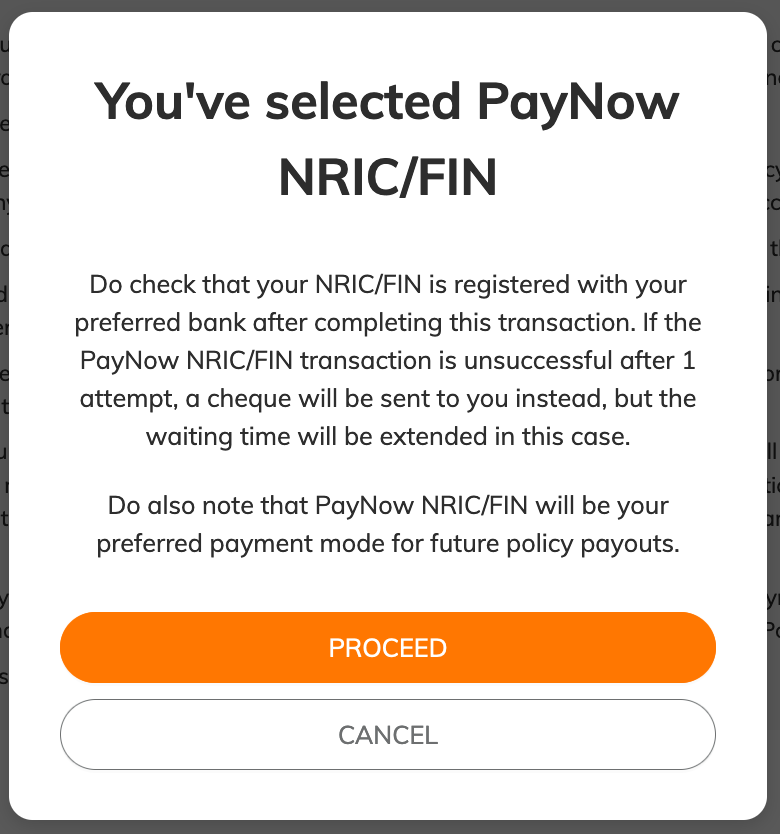

- Click "proceed" at the bottom after filling in how much you want to loan.

- Check through the details. At the bottom, there are some terms and conditions. Notably, if the amount you owe exceeds the cash value of the insurance, you will forfeit your policy. So be careful.

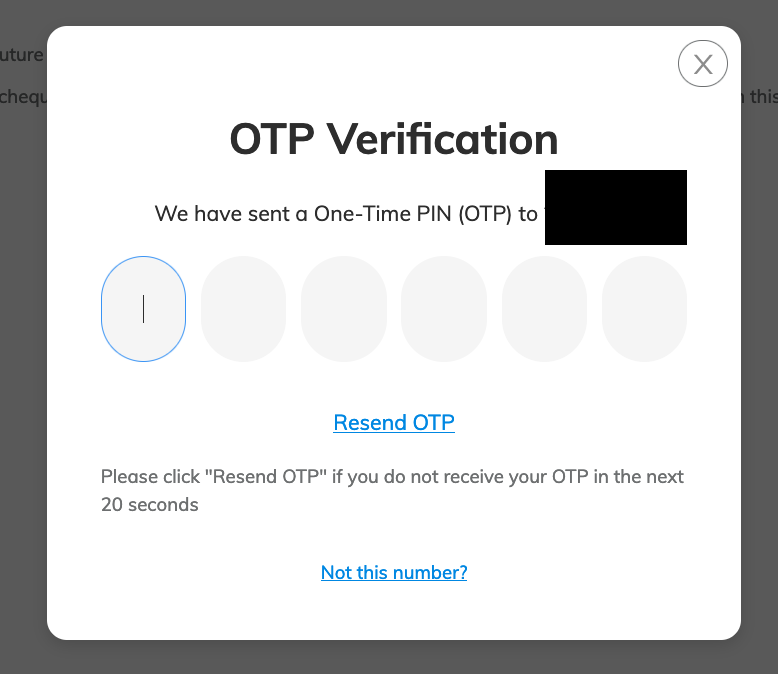

- You may be asked for an otp. Fill this in and you should be able to receive the loan.